|

Cash if flooding global money

markets, yet there is no inflation. Why not?

"There are scenarios that could

cause inflation expectations to run amok. But even in a worst

case, investors assume they'll have time to move to the exits.

It puzzles a lot of you, I know,

from your emails and your posts on my websites. Frankly, it

puzzles me. And I'd say that anyone who says this doesn't

puzzle them has more ego than sense.

The world's central banks have

flooded the global financial markets with cash -- and they're

still hooking up more and bigger hoses. The Bank of Japan

alone now promises to add $80 billion to the global money

supply each month.

And yet there's no inflation. There's no sign of inflation.

Investors aren't afraid of inflation. And inflation hedges

such as gold are sinking like a stone.

Does this make any sense?

Maybe.

You can find a potential key to unlocking this puzzle in "Turning

Japanese," the 1980 hit by The Vapors featuring the line

"I'm turning Japanese I really think so."

Source: http://t.money.msn.com/investing/what-happened-to-inflation

The reason I wanted to capture this in a teachable point of

view is to me, very important about METASYSTEMS.

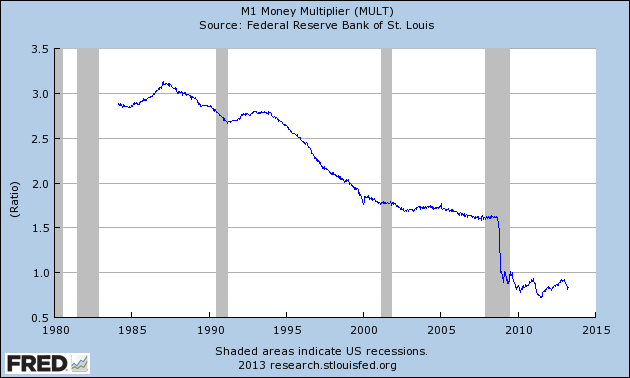

IF you look at this chart, taken the same day as the article

appeared in msn.com:

you can see that in order for monetary inflation to be

occurring, you need velocity in money as a multiplier.

|